Loan Programs - Vacaville, CA Things To Know Before You Get This

Not known Factual Statements About 5 grant and loan programs in Nevada that can help you buy a

With so lots of expenditures involved (believe closing costs, long-lasting loans, mortgages, and deposits) a house for you and your household might appear like a castle in the air in this economy. However do not offer up! Even if you're struggling financially, there are various homebuyer help programs in Nevada all set to help dedicated people like you.

Let's explore the very best programs for novice property buyers in Nevada. The first action, as constantly, is due diligence. You'll desire to research your options and educate yourself as much as possible. For You Can Try This Source , consider studying government sites such as HUD.GOV for precise details relating to homeownership assistance in Nevada, including statewide and local programs offered to eligible people.

In addition, it is necessary to learn more about the acquiring procedure, particularly for newbie homebuyers. An excellent place to begin is Cash Smart an FDIC financial education program created to help people of any ages sharpen their monetary abilities and develop favorable banking relationships. This can be really beneficial to novice property buyers obtaining a loan.

Biden's $25,000 First Time Home Buyer Program Explained! - YouTube

First time home buyer programs in all 50 states - Mortgage Rates, Mortgage News and Strategy : The Mortgage Reports

MAF Widget Feeling good about your background understanding? All set to explore the grant programs and property buyer programs available to novice Nevada home purchasers? Let's enter into it! Here are the programs you need to understand about: For novice property buyers in Nevada, a deposit support program called "Home Is Possible" can be an invaluable resource.

A First-Time Home Buyer's Guide to Down Payment Assistance Programs — South Kitsap Properties

Some Known Details About First Time Home Buyer Workshop Sponsored by Suntrust

This cash can be found in the type of a set rates of interest 30-year loan for as much as 5 percent of the overall mortgage worth. To put it simply, if you're getting a $150K home loan, this program could help you protect approximately $7,500 for your down payment and closing costs.

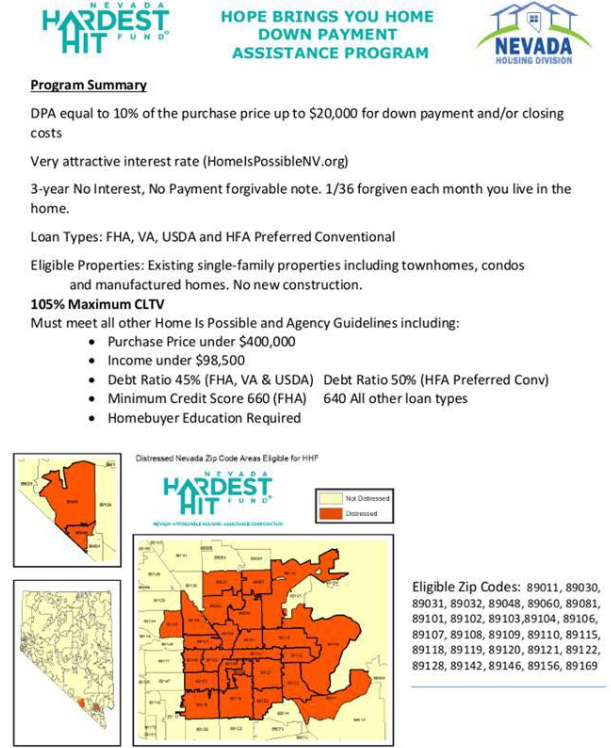

Available to citizens throughout the state of Nevada as a fixed-rate mortgage with a 30-year term, The loan can be as high as 5 percent of the house's overall loan amount. It should go straight towards costs connected with the home's closing and deposit, A minimum credit report of 640 is required, Your family's yearly earnings should be less than $98,500 and the home rate should be less than $510,400 You need to finish a property buyer education courseThe Home Is Possible program also works in tandem with the Home mortgage Credit Certificate (MCC) program provided through the Nevada Housing Department For extra borrower and residential or commercial property eligibility requirements, click on this link.